Owning a property is like running a small business and managing cash flow is critical to the survival of the property through different economic climates and to enable growth in value. To manage your asset effectively, you need to balance the outgoing costs with those of your income each month.

It is beneficial to set up regular cash flow forecasts, changing figures in light of any changes. Legislation, interest rates and tax changes will also impact on the forecast. Having a regular forecast of your cash flow, will enable you to:

- Anticipate when problems are likely to occur and action in advance

- Identify any potential cash shortfalls to take appropriate action

- Ensure sufficient cash flow before committing to any major financial expense

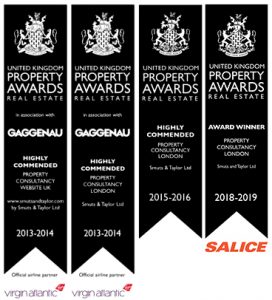

At Smuts and Taylor we will provide you with a cash flow analysis for every Investment opportunity we present, to enable you to make an informed decision about your investment and manage the property effectively.